How Location Affects Car Insurance Premiums: Urban vs. Rural

Sample meta description.

Understanding the Impact of Location on Car Insurance Rates

Okay, so you're looking for car insurance, and you think where you live doesn't matter? Think again! Your address is a HUGE factor in determining how much you'll pay. Insurance companies use a ton of data to assess risk, and location is a major piece of that puzzle. Let's break down why living in a bustling city versus a quiet countryside can drastically change your premiums.

Urban Car Insurance Rates: The High Cost of City Living

Living in a city? Get ready for potentially higher car insurance rates. Why? Well, cities are packed with cars, people, and… well, more opportunities for accidents. Here's a breakdown of the key factors:

- Higher Traffic Density: More cars on the road mean a greater chance of collisions. Stop-and-go traffic, aggressive drivers, and just the sheer volume of vehicles contribute to a higher accident rate.

- Increased Risk of Theft and Vandalism: Cities unfortunately also tend to have higher rates of car theft and vandalism. Insurance companies factor this into their calculations.

- Higher Repair Costs: City mechanics often charge more for labor, and parts can be more expensive due to higher demand and limited space.

- Population Density: More people mean more potential for accidents involving pedestrians, cyclists, and other vehicles.

Think of it this way: you're more likely to bump into someone on a crowded sidewalk than in the middle of a field, right? Same principle applies to cars in a city.

Rural Car Insurance Rates: The Perks of Peace and Quiet

Living in a rural area? Congratulations! You're likely to enjoy lower car insurance rates. The reasons are pretty straightforward:

- Lower Traffic Density: Fewer cars on the road mean a lower chance of collisions. You're more likely to encounter tractors than traffic jams.

- Lower Risk of Theft and Vandalism: Rural areas generally have lower crime rates, making your car less of a target for thieves and vandals.

- Lower Repair Costs: Rural mechanics often charge less for labor, and parts may be more affordable due to lower demand.

- Fewer Distractions: Less traffic, fewer pedestrians, and fewer distractions in general contribute to a safer driving environment.

Think of it as the opposite of city driving. You're cruising on open roads with fewer obstacles and fewer opportunities for accidents.

Comparing Car Insurance Costs Urban vs Rural Real-World Examples

Let's get specific. Imagine two drivers, both with clean driving records and similar cars. One lives in downtown Los Angeles, the other in a small town in Montana. The Los Angeles driver might pay $2,000 a year for car insurance, while the Montana driver might pay only $1,000. That's a significant difference, all due to location!

These are just examples, of course, and actual rates will vary depending on a ton of factors, including age, driving history, the type of car you drive, and the insurance company you choose. But the general trend is clear: urban areas = higher rates, rural areas = lower rates.

Car Insurance Discounts Available Based on Location

Even if you live in a high-risk area, there are still ways to save on car insurance. Here are a few discounts to look into:

- Safe Driver Discount: Maintain a clean driving record and you'll qualify for a discount.

- Multi-Car Discount: Insure multiple vehicles with the same company and you'll get a discount.

- Homeowner's Discount: Bundling your car and home insurance with the same company can save you money.

- Good Student Discount: If you're a student with good grades, you might qualify for a discount.

- Low Mileage Discount: If you don't drive much, you might qualify for a discount. This is especially relevant if you've moved from a city to a rural area and are now driving less.

Safety Features That Can Lower Car Insurance Premiums Regardless of Location

Investing in safety features can not only protect you in an accident, but also lower your car insurance premiums. Here are a few features to consider:

- Anti-Lock Brakes (ABS): Help prevent skidding and maintain control during braking.

- Electronic Stability Control (ESC): Helps prevent loss of control by automatically applying brakes to individual wheels.

- Airbags: Provide cushioning in the event of a collision.

- Lane Departure Warning System: Alerts you if you're drifting out of your lane.

- Blind Spot Monitoring System: Alerts you to vehicles in your blind spot.

- Automatic Emergency Braking (AEB): Automatically applies the brakes if it detects an imminent collision.

Many newer cars come standard with these features, but you can also add them to older vehicles. Check with your insurance company to see which safety features qualify for a discount.

Car Insurance Products and Usage Scenarios Detailed Comparison

Choosing the right car insurance policy can be confusing, so let's break down a few common types:

- Liability Insurance: This covers damages you cause to other people or property in an accident. It's required in most states and is the most basic type of coverage. Imagine you rear-end someone. Liability insurance covers their car repairs and medical bills (up to your policy limits).

- Collision Insurance: This covers damage to your car if you collide with another vehicle or object, regardless of who's at fault. Think of hitting a pothole and damaging your suspension. Collision insurance covers the repairs.

- Comprehensive Insurance: This covers damage to your car from things other than collisions, such as theft, vandalism, fire, hail, or falling objects. Imagine a tree falling on your car during a storm. Comprehensive insurance covers the repairs.

- Uninsured/Underinsured Motorist Coverage: This covers your medical bills and car repairs if you're hit by an uninsured or underinsured driver. Sadly, many people drive without adequate insurance, so this coverage is crucial.

- Personal Injury Protection (PIP): This covers your medical bills and lost wages, regardless of who's at fault in an accident. It's required in some states and can be very helpful.

Which type of coverage is right for you depends on your individual needs and budget. If you have a newer car, you'll probably want collision and comprehensive coverage. If you're on a tight budget, you might opt for liability-only coverage. Talk to an insurance agent to get personalized advice.

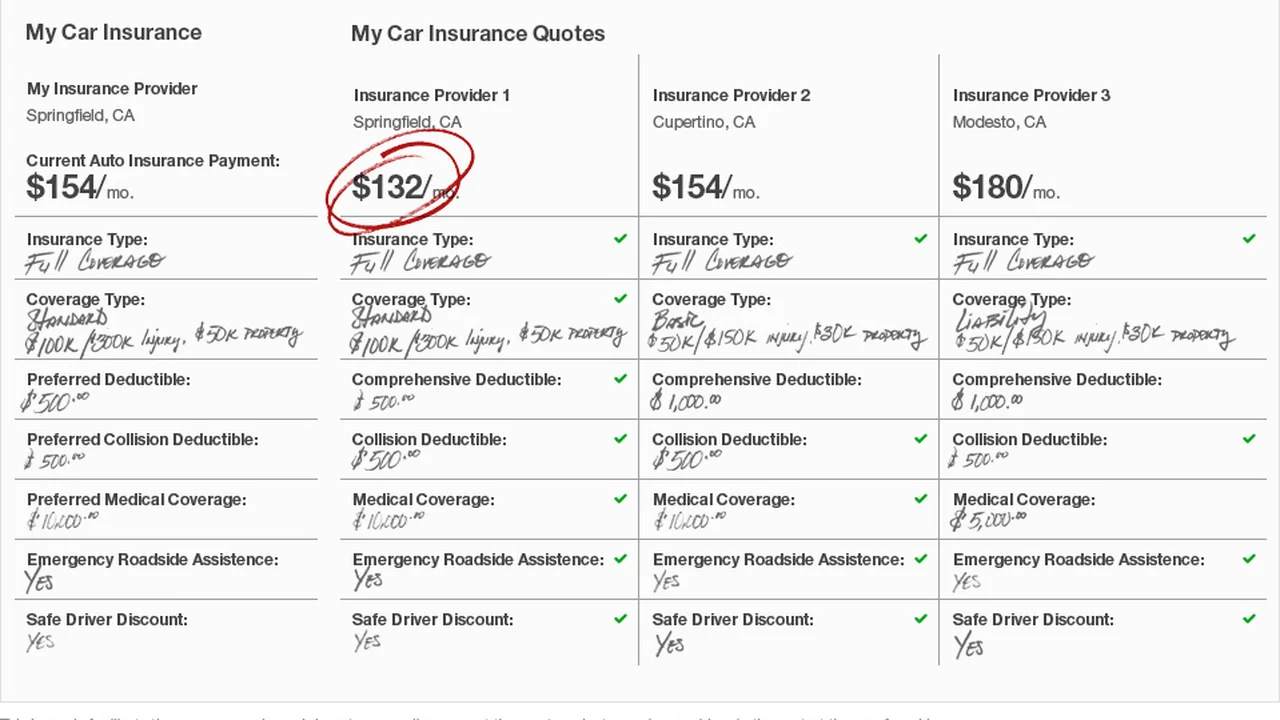

Specific Car Insurance Product Recommendations With Pricing

Okay, let's get into some actual product recommendations. Remember, prices can vary wildly based on your individual circumstances, so these are just examples.

Progressive Snapshot

Description: Progressive Snapshot is a usage-based insurance program that tracks your driving habits and rewards safe drivers with discounts. It uses a small device that plugs into your car's OBD-II port.

Usage Scenario: Ideal for drivers who are confident in their driving skills and are willing to share their driving data with Progressive. Especially useful for people who drive less frequently, as the discount is often proportional to mileage.

Pros: Potential for significant discounts (up to 30%), helps you become a safer driver by providing feedback on your driving habits.

Cons: Requires you to share your driving data, potential for higher rates if you have poor driving habits (hard braking, speeding, etc.).

Pricing: Varies based on driving habits. No upfront cost for the device, but your premium will be adjusted based on your driving data.

State Farm Drive Safe & Save

Description: Similar to Progressive Snapshot, State Farm Drive Safe & Save tracks your driving habits and rewards safe drivers with discounts. It uses a mobile app to track your driving.

Usage Scenario: Ideal for drivers who are comfortable using a mobile app and are willing to share their driving data with State Farm. Good for families with multiple drivers, as each driver can use the app.

Pros: Potential for discounts, convenient app-based tracking, provides feedback on your driving habits.

Cons: Requires you to share your driving data, potential for higher rates if you have poor driving habits. Battery drain on your phone if you forget to close the app.

Pricing: Varies based on driving habits. No upfront cost for the app, but your premium will be adjusted based on your driving data.

Allstate Drivewise

Description: Allstate Drivewise tracks your driving habits and rewards safe drivers with discounts. It uses a mobile app to track your driving.

Usage Scenario: Suitable for drivers who want to earn rewards for safe driving and are comfortable with mobile app tracking. Offers rewards even if you don't qualify for a discount on your premium.

Pros: Potential for discounts, rewards points even if you don't qualify for a discount, convenient app-based tracking.

Cons: Requires you to share your driving data, potential for higher rates if you have poor driving habits. Limited availability in some states.

Pricing: Varies based on driving habits. No upfront cost for the app, but your premium will be adjusted based on your driving data. You earn rewards points that can be redeemed for gift cards and other perks.

Comparing Car Insurance Providers

Choosing the right car insurance company is just as important as choosing the right coverage. Here's a quick comparison of a few popular providers:

| Company | Pros | Cons | Overall Rating |

|---|---|---|---|

| Progressive | Competitive rates, wide range of discounts, easy online quote process | Customer service can be inconsistent | 4/5 |

| State Farm | Excellent customer service, strong financial stability, wide range of products | Rates can be higher than some competitors | 4.5/5 |

| Allstate | Comprehensive coverage options, rewards program, good mobile app | Rates can be higher than some competitors | 4/5 |

| GEICO | Low rates, easy online quote process, strong financial stability | Customer service can be inconsistent | 3.5/5 |

Remember to get quotes from multiple companies before making a decision. Compare rates, coverage options, and customer service ratings to find the best fit for your needs.

Tips for Lowering Your Car Insurance Premiums No Matter Where You Live

Regardless of whether you live in a city or a rural area, here are a few tips to help you save money on car insurance:

- Shop around: Get quotes from multiple insurance companies and compare rates.

- Increase your deductible: A higher deductible means a lower premium.

- Maintain a good driving record: A clean driving record will qualify you for discounts.

- Take a defensive driving course: Some insurance companies offer discounts for completing a defensive driving course.

- Bundle your insurance: Insure your car and home with the same company and you'll get a discount.

- Review your coverage regularly: Make sure you have the right amount of coverage for your needs.

Final Thoughts on Location and Car Insurance

Location is a significant factor in determining your car insurance rates, but it's not the only factor. Your driving history, the type of car you drive, and the coverage options you choose all play a role. By understanding how location affects your premiums and taking steps to lower your costs, you can find affordable car insurance that meets your needs.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)