Comparing Car Insurance Quotes: Finding the Best Rates

Sample meta description.

Understanding Car Insurance Quotes and Why They Matter

Okay, let's be real. Car insurance isn't exactly the most thrilling topic. But understanding car insurance quotes? That's where the magic (and potential savings) happens! Think of it as shopping for anything else – you wouldn't just buy the first thing you see, right? You'd compare prices, features, and maybe even read some reviews. Car insurance is no different. Getting multiple quotes is crucial for finding the best deal and the right coverage for your needs.

Why does it matter so much? Well, besides the obvious legal requirement (you gotta have it to drive!), car insurance protects you financially if you're involved in an accident. It can cover damage to your car, the other person's car, medical bills, and even legal fees if you're sued. Without it, you could be facing some seriously hefty expenses.

Factors Influencing Car Insurance Rates: Decoding the Quote

So, what exactly goes into determining your car insurance rate? It's not just some random number pulled out of thin air (although sometimes it might feel like it!). Here are some of the key factors insurance companies consider:

- Your Driving Record: This is a big one. A clean driving record with no accidents or tickets will almost always get you a lower rate. Conversely, a history of accidents, speeding tickets, or DUIs will significantly increase your premium. Think of it like this: you're proving you're a safe driver.

- Your Age and Gender: Statistically, younger drivers (especially males) are more likely to be involved in accidents, so they typically pay higher rates. As you get older and gain more experience, your rates usually decrease. Gender also plays a role, with males often paying slightly more than females in certain age groups.

- Your Car: The make, model, and year of your car all influence your insurance rate. Expensive cars, sports cars, and cars that are more likely to be stolen will generally cost more to insure. Safety features can actually lower your rates (more on that later!).

- Your Location: Where you live matters. If you live in a densely populated area with high traffic and a higher risk of accidents, you'll likely pay more for insurance than someone who lives in a rural area. Crime rates in your area also play a role.

- Your Coverage Choices: The type and amount of coverage you choose will directly impact your premium. Higher liability limits, comprehensive and collision coverage, and add-ons like rental car reimbursement will all increase your cost.

- Your Credit Score: In many states, insurance companies can use your credit score to determine your rate. A good credit score can help you get a lower rate, while a poor credit score can increase your premium.

Where to Find Car Insurance Quotes: Online Tools and Local Agents

Alright, so you're ready to start shopping around. Where do you even begin? You've got a few options:

- Online Comparison Websites: These websites allow you to enter your information once and receive quotes from multiple insurance companies. They're a great way to quickly compare rates and coverage options. Just be aware that not all insurance companies participate in these websites, so you might not be seeing the full picture.

- Directly from Insurance Companies: You can also get quotes directly from individual insurance companies by visiting their websites or calling them directly. This can be a bit more time-consuming, but it allows you to get quotes from companies that might not be on comparison websites.

- Independent Insurance Agents: These agents work with multiple insurance companies and can help you find the best coverage at the best price. They can also provide personalized advice and answer any questions you might have. The advantage here is having someone advocate for you.

- Captive Insurance Agents: These agents work exclusively for one insurance company. While they can offer expertise on that company's products, they can't compare rates from other insurers.

Car Insurance Discounts: Ways to Lower Your Premium

Here's the good news: there are several ways to lower your car insurance premium. Be sure to ask about these discounts when you're getting quotes:

- Safe Driver Discount: As mentioned earlier, a clean driving record is key.

- Good Student Discount: If you're a student with good grades, you might be eligible for a discount.

- Multi-Policy Discount: Bundling your car insurance with other insurance policies, like homeowners or renters insurance, can often save you money.

- Vehicle Safety Features Discount: Cars with anti-lock brakes, airbags, and other safety features may qualify for a discount.

- Anti-Theft Device Discount: Installing an anti-theft device, like an alarm system or GPS tracking device, can also lower your premium.

- Low Mileage Discount: If you don't drive much, you might be eligible for a discount.

- Affiliation Discounts: Some insurers offer discounts to members of certain organizations, like alumni associations or professional groups.

- Payment Discounts: Paying your premium in full or setting up automatic payments can sometimes earn you a discount.

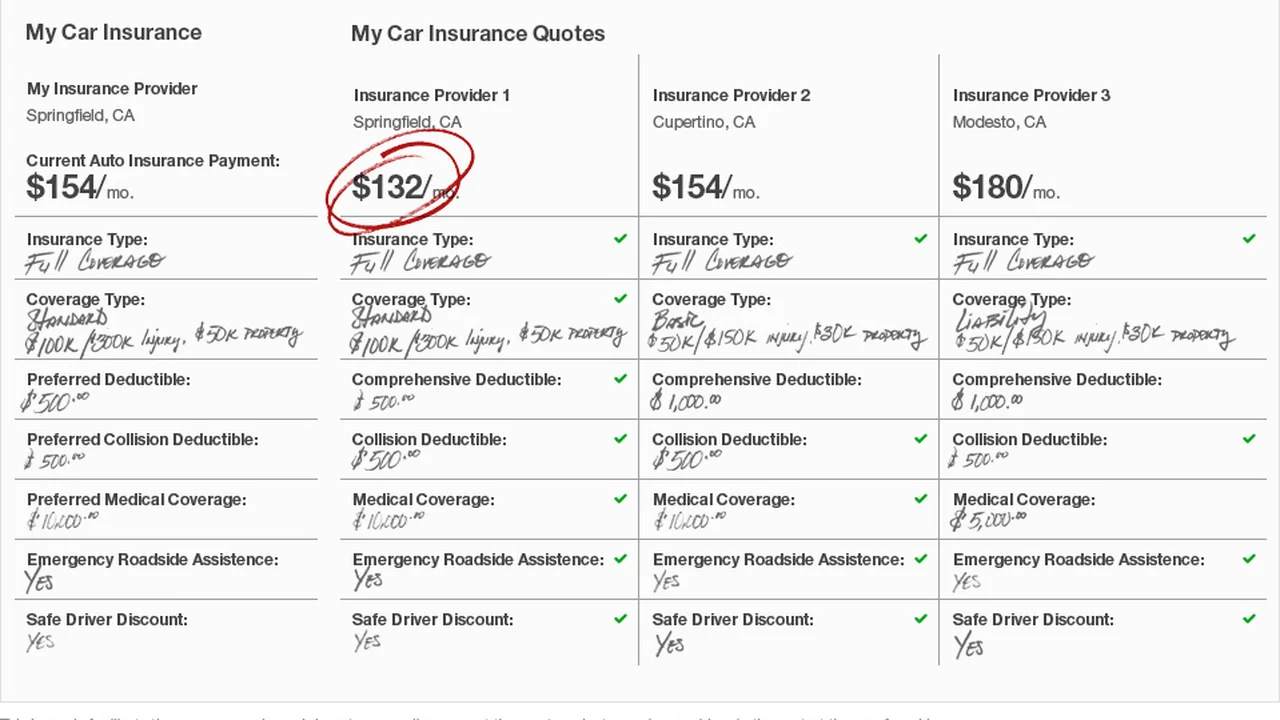

Comparing Car Insurance Quotes: What to Look For

Okay, you've got a stack of quotes in front of you. Now what? Don't just focus on the price. Here's what else to consider:

- Coverage Limits: Make sure you understand the coverage limits for each policy. How much will the insurance company pay out if you're involved in an accident? Adequate liability coverage is crucial to protect your assets.

- Deductibles: The deductible is the amount you'll pay out of pocket before your insurance coverage kicks in. A higher deductible will typically result in a lower premium, but you'll need to be prepared to pay more if you have an accident.

- Coverage Types: Make sure you're comparing apples to apples. Does each policy include the same types of coverage, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage?

- Exclusions: Read the fine print and understand what's not covered by the policy.

- Reputation of the Insurance Company: Check online reviews and ratings to see what other customers have to say about the insurance company's customer service and claims handling process.

Product Recommendations and Comparisons

State Farm: A Reliable Choice for Comprehensive Coverage

State Farm is a well-established insurance company known for its reliable customer service and comprehensive coverage options. They offer a wide range of car insurance products, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. They also offer several discounts, such as the safe driver discount, good student discount, and multi-policy discount.

Use Case: State Farm is a good choice for drivers who want comprehensive coverage and excellent customer service. They're particularly well-suited for families with multiple drivers and vehicles.

Pricing: State Farm's rates are generally competitive, but they may not be the cheapest option. Expect to pay around $1200 - $1800 annually for full coverage, depending on your individual circumstances.

Geico: The Budget-Friendly Option

Geico is known for its low rates and aggressive advertising. They offer a variety of car insurance products, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. They also offer several discounts, such as the safe driver discount, good student discount, and military discount.

Use Case: Geico is a good choice for drivers who are looking for the cheapest possible rates. They're particularly well-suited for young drivers and those with clean driving records.

Pricing: Geico's rates are typically among the lowest in the industry. Expect to pay around $800 - $1400 annually for full coverage, depending on your individual circumstances.

Progressive: A Leader in Usage-Based Insurance

Progressive is known for its innovative usage-based insurance program, Snapshot. Snapshot tracks your driving habits and rewards safe drivers with lower rates. They also offer a variety of other car insurance products, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. They offer features like Name Your Price tool.

Use Case: Progressive is a good choice for drivers who are willing to share their driving data in exchange for potentially lower rates. They're particularly well-suited for safe drivers who drive relatively few miles.

Pricing: Progressive's rates can vary depending on your driving habits. Expect to pay around $900 - $1600 annually for full coverage, depending on your individual circumstances and Snapshot results.

Comparing the Products

Here's a quick comparison table:

| Company | Pros | Cons | Approximate Annual Cost (Full Coverage) |

|---|---|---|---|

| State Farm | Excellent customer service, comprehensive coverage | May not be the cheapest option | $1200 - $1800 |

| Geico | Lowest rates, widely available | Customer service can be inconsistent | $800 - $1400 |

| Progressive | Usage-based insurance, potential for significant savings | Requires tracking driving habits | $900 - $1600 |

The Importance of Reading Reviews and Understanding Policy Details

Don't just take the insurance company's word for it. Read online reviews from other customers to get a sense of their experiences with the company. Pay attention to reviews that mention customer service, claims handling, and billing issues. And most importantly, read your policy carefully to understand the coverage limits, deductibles, and exclusions. Know what you're buying before you commit!

Car Insurance Safety Features That Can Save You Money

As mentioned earlier, many car insurance companies offer discounts for vehicles equipped with safety features. Here are some of the most common safety features that can help you save money:

- Anti-lock Brakes (ABS): ABS helps prevent skidding and allows you to maintain steering control during emergency braking.

- Airbags: Airbags provide cushioning in the event of a collision, reducing the risk of injury.

- Electronic Stability Control (ESC): ESC helps prevent loss of control by automatically applying the brakes to individual wheels when the vehicle starts to skid.

- Lane Departure Warning System (LDWS): LDWS alerts you if you start to drift out of your lane.

- Blind Spot Monitoring System (BSM): BSM alerts you if there's a vehicle in your blind spot.

- Automatic Emergency Braking (AEB): AEB automatically applies the brakes if it detects an imminent collision.

- Rearview Camera: Rearview cameras help you see what's behind you when you're backing up, reducing the risk of accidents.

Having these features not only makes you safer, but it also saves you money. It's a win-win!

Final Thoughts: Shop Around and Stay Informed

Finding the best car insurance rates takes time and effort, but it's well worth it. Shop around, compare quotes, and understand your coverage options. Don't be afraid to ask questions and negotiate with insurance companies. And remember, the cheapest policy isn't always the best policy. Choose a policy that provides adequate coverage and meets your individual needs. Drive safe out there!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)