Diminished Value Claims: Recovering Compensation for Vehicle Depreciation

Sample meta description.

Understanding Diminished Value What Is It And How Does It Work

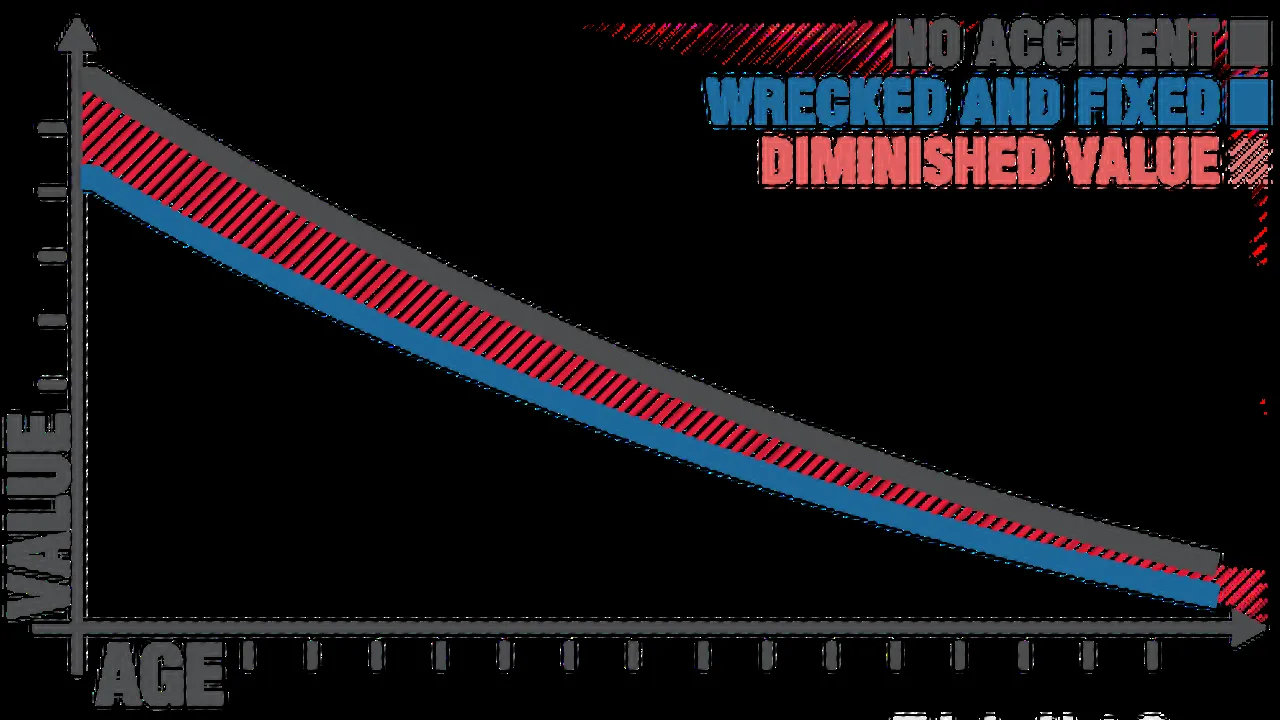

So, you've been in an accident. Not fun, right? Even after your car is repaired, it's probably not worth what it was before the fender-bender. That’s where diminished value comes in. It's the difference between your vehicle's pre-accident value and its post-repair value. Think of it as the "scar" on your car's record, making it less attractive to buyers. Basically, even if your car looks brand new after the repairs, it's still considered "damaged" in the eyes of potential buyers, and that affects its resale price. You're entitled to compensation for that loss in value.

There are three main types of diminished value: Inherent Diminished Value (the automatic loss in value simply because the car was in an accident), Repair-Related Diminished Value (loss in value because of substandard repairs), and Claim-Related Diminished Value (loss in value due to delays or improper handling of your claim). We're mostly talking about inherent diminished value here.

Who Can Claim Diminished Value And When Is It Applicable Accident Claim Eligibility

Not everyone can just waltz in and claim diminished value. Usually, you need to be the claimant – meaning the accident wasn't your fault. If you were at fault, you're unlikely to get anywhere with a diminished value claim. Also, the damage needs to be significant enough to actually affect the car's value. A minor scratch probably won't cut it. You're also generally dealing with a situation where the other driver was at fault. In some states, you can pursue diminished value claims against your own insurance company under uninsured/underinsured motorist coverage if the at-fault driver doesn't have sufficient insurance.

The age and mileage of your vehicle also matter. A brand-new car with low mileage will have a much larger diminished value claim than a ten-year-old car with 200,000 miles. Think about it: a small hit on a brand new car makes a big dent in its perceived value, whereas that same hit on an older car is just a drop in the bucket.

Gathering Evidence For Your Diminished Value Claim Proving Your Loss

Okay, so you think you have a valid claim. Now comes the fun part: proving it! You'll need solid evidence to convince the insurance company that your car really did lose value. Start by getting a professional appraisal from a qualified appraiser specializing in diminished value assessments. These guys know their stuff and can provide an expert opinion on the exact amount of value your car lost. These appraisals cost money, but the potential payout from your claim is often worth it.

Also, collect all the documents related to the accident and the repairs. Police reports, repair bills, photos of the damage – everything! The more evidence you have, the stronger your case will be. Get copies of the vehicle's title and registration. Gather evidence of pre-accident condition, such as service records. And don't forget to document everything! Keep a detailed record of all communication with the insurance company.

Negotiating With The Insurance Company Diminished Value Settlement Strategies

Dealing with insurance companies can be… challenging. They're not exactly known for willingly handing over large sums of money. Be prepared to negotiate. Start by presenting your appraisal and all your supporting documents. Be polite but firm. Don't be afraid to push back if they offer you a lowball settlement. Remember, they're trying to minimize their payout. You're trying to get what you deserve.

Do your research. Find comparable vehicles for sale in your area that haven't been in accidents. This will give you a good idea of what your car would have been worth before the accident. Use websites like Kelley Blue Book and Edmunds to get an idea of your vehicle's value. Be prepared to counter their arguments. They might try to argue that the damage wasn't that severe or that your car's value didn't really decrease that much. Be ready to explain why their arguments are wrong. If you're feeling overwhelmed, consider hiring a lawyer who specializes in diminished value claims. They can handle the negotiations for you and make sure you get a fair settlement.

Diminished Value Claim Products Recommendations And Comparisons

While there aren't exactly "products" to directly *fix* diminished value (it's a financial loss, not a physical one), there are tools and services that can help you navigate the process and maximize your claim. Here are a few recommendations:

Diminished Value Appraisal Services Comparing Options And Pricing

Several companies offer diminished value appraisal services. Here are a few popular options:

* **Autoloss:** Autoloss is a well-known appraisal company that specializes in diminished value claims. They offer comprehensive appraisals and expert testimony. Their pricing typically starts around $300-$500, depending on the complexity of the case. They're known for their thoroughness and attention to detail, making them a good choice for complex claims. Use case: if you have significant damage and a newer vehicle, Autoloss could be a good option. * **DVAA (Diminished Value Appraisers Association):** DVAA is an association of certified diminished value appraisers. They can connect you with a qualified appraiser in your area. Pricing varies depending on the appraiser, but expect to pay around $250-$400. They are a good choice if you prefer to work with a local appraiser. Use case: if you prefer a local appraiser and want to support a professional association, DVAA is a good choice. * **Expert Auto Appraisals:** Expert Auto Appraisals offers online and on-site appraisals. Their online appraisals are generally more affordable, starting around $200. On-site appraisals are more expensive but can be more accurate. Use case: if you need a quick and affordable appraisal, Expert Auto Appraisals online option is a good choice.When choosing an appraisal service, consider their experience, reputation, and pricing. Read reviews and compare quotes before making a decision.

Claim Negotiation Tools and Resources Automating Your Claim Process

While you can't fully automate the negotiation process, several tools and resources can help you stay organized and informed:

* **ClaimZen:** ClaimZen is a cloud-based platform that helps you manage your insurance claims. It allows you to track your claim status, upload documents, and communicate with the insurance company. It also provides access to legal resources and expert advice. Pricing starts around $29 per month. Use case: if you want to stay organized and track your claim progress, ClaimZen is a good choice. * **Nolo's Insurance Claim Kit:** Nolo offers a comprehensive insurance claim kit that includes forms, letters, and legal information. It's a great resource for understanding your rights and preparing your claim. The kit costs around $50. Use case: if you prefer a more hands-on approach and want to learn more about your rights, Nolo's Insurance Claim Kit is a good choice. * **LegalZoom:** LegalZoom offers access to attorneys who can review your claim and provide legal advice. Pricing varies depending on the attorney and the complexity of the case. Use case: if you need legal assistance but don't want to hire a full-time attorney, LegalZoom is a good choice.Vehicle History Reports Uncovering Accident History And Value

These aren't exactly products for filing a diminished value claim, but understanding the vehicle history is paramount. These tools help you see the impact of the accident on the vehicle's record:

* **Carfax:** Carfax is the most well-known vehicle history report provider. It provides detailed information about a vehicle's accident history, ownership history, and service records. A single report costs around $40. Use case: if you want a comprehensive overview of a vehicle's history, Carfax is a good choice. * **AutoCheck:** AutoCheck is another popular vehicle history report provider. It offers similar information to Carfax but uses a different scoring system. A single report costs around $30. Use case: if you want a second opinion on a vehicle's history, AutoCheck is a good choice. * **VinAudit:** VinAudit is a more affordable vehicle history report provider. It provides basic information about a vehicle's accident history and ownership history. A single report costs around $10. Use case: if you need a quick and affordable vehicle history report, VinAudit is a good choice.Remember to compare prices and features before choosing a vehicle history report provider. Look for reports that include accident details, damage estimates, and title information.

Taking Legal Action When To Hire An Attorney For Diminished Value

If you've exhausted all other options and the insurance company is still refusing to offer a fair settlement, it might be time to lawyer up. A lawyer specializing in diminished value claims can assess your case, negotiate with the insurance company, and even file a lawsuit if necessary. They can be expensive, but they can also significantly increase your chances of getting a fair settlement.

Consider hiring a lawyer if the damage to your vehicle was significant, the insurance company is being unreasonable, or you're simply feeling overwhelmed by the process. Look for a lawyer who has experience with diminished value claims and a proven track record of success. Ask for referrals from friends or family, or search online for lawyers in your area. Don't be afraid to interview several lawyers before making a decision.

Documenting Everything Throughout The Diminished Value Claim Process

Seriously, document EVERYTHING. Keep copies of all correspondence with the insurance company, including emails, letters, and phone call logs. Take photos of the damage to your vehicle. Keep records of all expenses related to the claim, such as appraisal fees and legal fees. The more documentation you have, the stronger your case will be. This is your evidence; treat it as such.

Store all your documents in a safe place, both physically and digitally. Consider creating a dedicated folder on your computer or using a cloud-based storage service. Back up your files regularly to prevent data loss. You never know when you might need to refer back to a document, so it's always better to be prepared.

Understanding State Laws Regarding Diminished Value Claims State-Specific Regulations

Diminished value laws vary from state to state. Some states allow diminished value claims against the at-fault driver's insurance company, while others don't. Some states have caps on the amount of diminished value you can recover. It's important to understand the laws in your state before pursuing a claim. Do some research online, or consult with a lawyer who specializes in diminished value claims in your state. Knowing your rights is half the battle.

For example, some states require you to file your claim within a certain timeframe after the accident. Others require you to prove that the repairs were performed to a certain standard. Understanding these nuances can make a big difference in the outcome of your claim. Don't assume that the laws in your state are the same as the laws in another state. Do your homework!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)